Image From : gemini.google.com

In the modern financial landscape, the concept of “financial freedom” has moved from a distant dream to an attainable goal for many. At the core of this pursuit lies a crucial principle: making your money work for you. This is the essence of passive income—earnings that require minimal to no active involvement to maintain. Unlike traditional jobs where you trade time for money, passive income streams provide a consistent flow of capital, liberating you from the constant hustle and offering the security to live life on your own terms. This article will delve into some of the most effective and popular passive income investments that can pave the way to financial independence.

The Foundation of Passive Income: Understanding the “Passive” in the Name

Before exploring specific investments, it’s vital to clarify what “passive” truly means. No investment is completely passive from day one. All require an initial investment of either time, money, or both. The “passive” element kicks in once the system is established. For example, building a rental property portfolio requires a significant upfront investment of capital and time to find, purchase, and manage the properties. Once a property manager is hired, the income from rent becomes largely passive. The goal is to build systems and assets that generate cash flow with minimal ongoing effort.

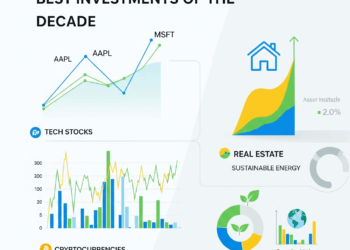

1. Real Estate: The Classic Path to Wealth

Real estate has long been a cornerstone of passive income strategies, celebrated for its ability to generate steady cash flow and appreciate in value over time.

Rental Properties: The most traditional form of real estate passive income involves purchasing a property (residential or commercial) and renting it out to tenants. The rent collected, minus expenses like mortgage payments, taxes, insurance, and maintenance, constitutes your passive income. For a truly hands-off approach, many investors hire a property management company, which handles everything from finding tenants to dealing with repairs, for a percentage of the monthly rent.

Real Estate Investment Trusts (REITs): For those who want to invest in real estate without the direct management of a physical property, REITs are an excellent alternative. A REIT is a company that owns, and in most cases operates, income-producing real estate. They are required by law to distribute at least 90% of their taxable income to shareholders, making them a fantastic source of dividend income. Investing in a REIT is as simple as buying shares through a brokerage account, much like buying stocks. This offers diversification across a portfolio of properties and a level of liquidity that direct property ownership lacks.

Real Estate Crowdfunding: Technology has opened up new avenues for real estate investment. Platforms like Fundrise or CrowdStreet allow investors to pool their money to invest in larger-scale commercial real estate projects. This lowers the barrier to entry, as you can invest with much smaller amounts than required for a full property purchase. While the returns can be attractive, it’s important to research the platform and the specific projects carefully.

2. The Stock Market: Dividends and Beyond

The stock market is a powerful engine for building passive income, primarily through dividends and interest.

Dividend Stocks: Many publicly traded companies distribute a portion of their profits to shareholders in the form of dividends. Investing in a portfolio of stable, dividend-paying stocks from established companies (often referred to as “blue-chip” stocks) can provide a reliable stream of passive income. By reinvesting these dividends, you can compound your returns, growing your portfolio and your income stream exponentially over time.

Dividend ETFs and Mutual Funds: To mitigate the risk of a single company cutting its dividend, many investors opt for Dividend Exchange-Traded Funds (ETFs) or mutual funds. These funds hold a basket of dividend-paying stocks, providing instant diversification. Examples include funds that track the S&P 500 Dividend Aristocrats, which are companies that have increased their dividends for at least 25 consecutive years.

Bonds and Bond Funds: When you buy a bond, you are essentially loaning money to a government or corporation. In return, they promise to pay you back the principal amount at a future date and make regular interest payments in the meantime. Bond funds offer a diversified way to invest in a portfolio of bonds, providing a steady stream of interest income. While typically lower-risk than stocks, their returns are also generally lower.

3. Creating Digital Assets: Leveraging the Internet

The digital age has introduced an array of passive income opportunities that leverage the power of the internet and automation.

Affiliate Marketing: This involves earning a commission by promoting other companies’ products or services. You can create a blog, a YouTube channel, or a social media page, and embed unique affiliate links. When a visitor clicks your link and makes a purchase, you earn a commission. While creating the content requires initial effort, a well-established and popular content platform can generate income for years with minimal maintenance.

Selling Digital Products: If you have expertise in a specific area, you can create and sell digital products such as e-books, online courses, stock photos, or printable templates. The creation process is a one-time effort, but the product can be sold an infinite number of times. Setting up an e-commerce platform and marketing your products will be the initial investment of time, after which the sales can become a significant source of passive income.

YouTube Monetization: Building a successful YouTube channel requires a substantial initial investment in content creation and audience building. However, once your channel has a strong following, it can generate passive income through advertising revenue (AdSense), sponsorships, and merchandise sales. Older videos can continue to attract viewers and generate revenue for years to come.

4. Alternative Investments: Beyond the Traditional

For those with a higher risk tolerance and an interest in less conventional assets, there are several other avenues to explore.

Peer-to-Peer (P2P) Lending: Platforms like LendingClub allow you to lend money to individuals or small businesses. The platform handles the vetting and administration, and you earn interest on the loan as the borrower repays it. While the potential returns can be high, the risk of default is also present, so diversification across many loans is key.

Vending Machines or Laundromats: While they require a more hands-on approach initially, these small businesses can be semi-passive. Once a location is secured and the machines are installed, your primary tasks are to collect the cash and perform maintenance. Hiring a service provider can make this even more passive.

Building Your Passive Income Portfolio

The key to achieving financial freedom through passive income is not to rely on a single source, but to build a diversified portfolio. A balanced strategy might include:

- A strong foundation: Investing in dividend stocks and a REIT to generate consistent, reliable income.

- A growth engine: Reinvesting some of the passive income into higher-growth assets or new ventures.

- A passion project: Using a digital asset like a blog or YouTube channel to build a brand and an additional revenue stream.

Financial freedom isn’t about never working again; it’s about having the choice to do so. By strategically investing in passive income streams, you can build a safety net that protects you from economic uncertainty and provides the financial leverage to pursue your passions without the pressure of a paycheck. The journey begins with a single step—educating yourself and making that first strategic investment. The compounding effect of time and smart financial decisions will do the rest, transforming your hard-earned money into a powerful engine for your future.