Image From : gemini.google.com

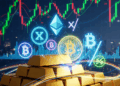

The year 2025 stands at a unique crossroads for investors, offering a blend of time-tested assets and revolutionary digital frontiers. As global economic landscapes shift and technological advancements accelerate, the traditional safety net of gold and the volatile, high-growth potential of cryptocurrencies present a compelling dichotomy. Navigating this environment requires a strategic, informed, and diversified approach. This article explores key investment tips for successfully incorporating both gold and cryptocurrencies into your portfolio in 2025.

Understanding the Core Roles: Gold vs. Crypto

Before diving into investment strategies, it’s crucial to understand the fundamental roles these two assets play. Gold, for centuries, has been the ultimate store of value, a hedge against inflation, and a safe haven during economic instability. Its value is rooted in its scarcity, durability, and a deep-seated human trust. In 2025, gold continues to serve this purpose, particularly amidst geopolitical tensions and concerns over sovereign debt.

Cryptocurrencies, led by Bitcoin and Ethereum, represent a new paradigm. They are decentralized, programmable, and operate on a transparent blockchain. While their volatility is a defining characteristic, it’s also the source of their potential for exponential growth. In 2025, the crypto market is maturing, with increased institutional adoption, regulatory clarity in some regions, and the rise of new use cases like decentralized finance (DeFi) and non-fungible tokens (NFTs).

Tip 1: Diversify, Diversify, Diversify

The golden rule of investing is especially pertinent here. Rather than viewing gold and crypto as competing assets, smart investors see them as complementary. Gold can provide stability and act as a ballast for your portfolio, offsetting the wild swings of the crypto market. Conversely, a small, strategic allocation to cryptocurrencies offers the potential for significant upside that gold, with its more measured returns, cannot match. A balanced portfolio might allocate a larger percentage to gold for security and a smaller, more speculative portion to a basket of carefully selected cryptocurrencies.

Tip 2: Do Your Homework on Cryptocurrencies

The days of blindly buying any crypto with a clever name are over. The 2025 crypto market is a jungle of thousands of coins, and a significant number of them are likely to fail. Due diligence is non-negotiable. Focus on foundational projects with real-world utility and strong development teams. Bitcoin and Ethereum remain the cornerstones of the market, but exploring promising Layer-2 solutions, DeFi protocols with audited smart contracts, or projects with clear business models is essential. Understand the technology, the whitepaper, and the community behind a project before committing any capital.

Tip 3: Consider the “How” of Gold Investment

Investing in gold isn’t just about buying a physical bar. While physical gold offers the most direct ownership, it also comes with security and storage challenges. In 2025, many investors opt for more liquid and accessible options. Gold ETFs (Exchange-Traded Funds) allow you to gain exposure to the price of gold without the hassle of physical ownership. For those who prefer physical possession, reputable dealers and secure vault services are the way to go. Furthermore, gold mining stocks can offer leverage to the price of gold, but they come with their own set of company-specific risks.

Tip 4: Embrace Dollar-Cost Averaging (DCA)

Both gold and cryptocurrencies benefit from a disciplined investment approach. The emotional rollercoaster of buying and selling based on daily price movements is a surefire way to lose money. Dollar-cost averaging, or investing a fixed amount of money at regular intervals, removes emotion from the equation. This strategy allows you to buy more when prices are low and less when they are high, smoothing out your average purchase price over time. It’s a particularly powerful strategy for the volatile crypto market, but it also works well for building a gold position over the long term.

Tip 5: Stay Informed on Regulation and Technology

The regulatory landscape for cryptocurrencies is a dynamic and evolving space. In 2025, a favorable regulatory environment in one country could spur institutional investment, while a crackdown in another could trigger a market downturn. Staying abreast of these developments is crucial. Similarly, for gold, understanding central bank policies and global economic indicators is key. On the technological front, keep an eye on innovations in the crypto space, such as advancements in blockchain scalability or new security protocols, as these can significantly impact the value of different projects.

Conclusion

Investing in gold and cryptocurrencies in 2025 is not about choosing one over the other. It’s about harnessing the unique strengths of both to build a resilient and growth-oriented portfolio. Gold provides the foundation of stability and a hedge against uncertainty, while cryptocurrencies offer the potential for transformative returns. By diversifying wisely, conducting thorough research, utilizing smart investment techniques like DCA, and staying informed, investors can navigate this exciting landscape and position themselves for success in the years to come.