Image From : gemini.google.com

The last ten years have been a transformative period for the global economy and investment landscape. From the dawn of the mobile-first era to the explosion of artificial intelligence, a host of technological, social, and economic forces have reshaped the markets. For investors, this decade presented a unique mix of unprecedented opportunities and significant volatility. A look back at the best-performing investments of this period offers valuable lessons on what drives returns, the importance of diversification, and how to position a portfolio for the future.

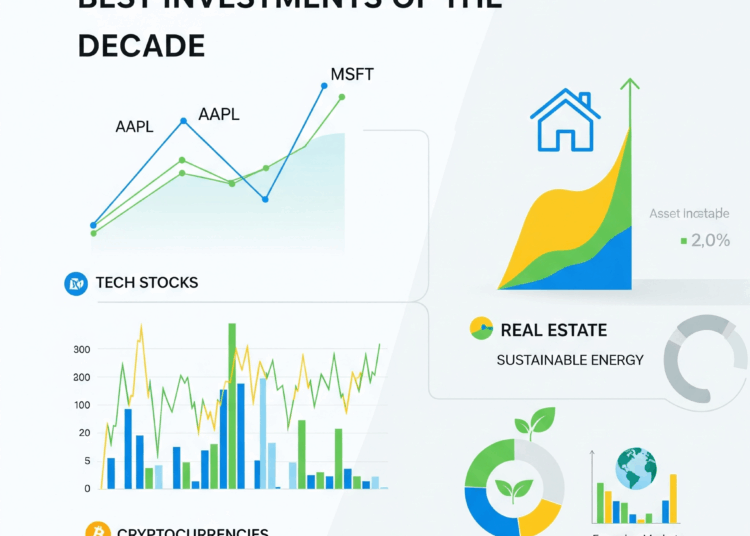

The Rise of the Tech Titans and the “Magnificent Seven”

No discussion of the past decade’s top investments would be complete without acknowledging the dominance of the technology sector. The so-called “Magnificent Seven” – a group of leading tech companies including Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), Nvidia, and Tesla – have been the primary engine of market growth. These companies are more than just stocks; they are fundamental pillars of modern society, driving innovation in everything from e-commerce and cloud computing to social media and electric vehicles.

The performance of these stocks has been nothing short of spectacular. Nvidia, for example, has seen its valuation skyrocket, initially fueled by its dominance in the gaming and data center markets and more recently by its indispensable role in the AI revolution. Similarly, Tesla’s rise from a niche electric car manufacturer to a global powerhouse has been a testament to its technological innovation and charismatic leadership. Microsoft and Apple, already giants at the beginning of the decade, have reinvented themselves through a focus on services, subscriptions, and ecosystem dominance, rewarding long-term shareholders handsomely.

The key takeaway from the tech boom is the power of disruptive innovation. Companies that successfully identified and capitalized on megatrends like cloud computing, digital advertising, and the transition to electric mobility have delivered outsized returns. However, this high performance came with high volatility. These stocks have experienced significant drawdowns, reminding investors that even the best companies are not immune to market corrections.

The Resurgence of Cryptocurrencies

While traditional stocks were making headlines, a new, volatile, but immensely profitable asset class emerged: cryptocurrencies. Bitcoin, the first and largest cryptocurrency, began the decade as a fringe asset but ended it as a mainstream investment, with institutional interest and a market cap in the trillions. The performance of Bitcoin and other cryptocurrencies has been explosive, driven by a combination of speculative fervor, increasing adoption, and its perceived role as a hedge against inflation and traditional financial systems.

For early investors, the returns have been life-changing. However, the crypto market is defined by its extreme volatility. A single year can see Bitcoin’s value increase by hundreds or even thousands of percent, only to fall by 50% or more in the next. This has made it a polarizing investment: a high-conviction bet for some and a speculative gamble for others. The decade has proven that while the potential for high returns is real, it comes with a level of risk and psychological endurance that is not suitable for every investor.

The Steady and Unsung Heroes: Index Funds and Passive Investing

In the shadow of the spectacular returns from tech stocks and crypto, a quiet revolution was taking place. The decade saw a dramatic shift towards passive investing, primarily through low-cost index funds and Exchange-Traded Funds (ETFs). An investment in a broad-market index, such as the S&P 500, delivered consistent and impressive returns, proving that you don’t need to be a stock-picking genius to build significant wealth.

The performance of the S&P 500 over the last ten years has been robust, delivering strong annualized returns. This was largely due to the index’s concentration in the tech sector, but it also reflects the overall health and resilience of the U.S. economy. The beauty of passive investing lies in its simplicity and diversification. By owning a slice of the entire market, investors mitigated the risk of a single stock’s failure while benefiting from the growth of the overall economy. This strategy has been championed by legendary investors like Warren Buffett and has proven to be an effective, low-stress path to long-term wealth accumulation.

Real Estate and Alternative Investments

Beyond the public markets, the real estate sector also performed well in many regions, particularly in residential markets. Low interest rates for much of the decade fueled a strong housing market, leading to significant appreciation in property values. For many, real estate investments, both direct and through vehicles like Real Estate Investment Trusts (REITs), provided a stable source of income and capital growth.

Alternative investments, such as private equity and venture capital, also saw a boom. As tech companies remained private for longer, these funds offered a way for accredited investors to gain exposure to high-growth startups before they went public. While these investments are typically illiquid and carry higher risks, they have been a source of extraordinary returns for those with the capital and risk tolerance to participate.

A Decade of Lessons and a Look Forward

The last ten years have taught investors several crucial lessons. First, megatrends matter. Identifying and investing in the forces that are shaping the future—be it digitalization, sustainability, or demographic shifts—can lead to remarkable returns. Second, diversification is a non-negotiable principle. While a few high-flyers dominated headlines, a well-diversified portfolio that includes both traditional and alternative assets can smooth out volatility and protect against unforeseen risks. Third, patience is a virtue. The best investments of the decade were not found through constant trading but by holding positions through market highs and lows, allowing the power of compounding to work its magic.

As we look ahead, the lessons from the last decade will continue to be relevant. The rise of AI, new energy technologies, and the ever-expanding digital world will create the next generation of top-performing investments. The challenge for investors will be to filter through the noise, stay disciplined, and build a portfolio that is resilient, diversified, and aligned with the long-term trends shaping our world. The past is a powerful teacher, and its performance review provides a clear roadmap for the decade to come.